The Ultimate Guide To Top 30 Forex Brokers

Table of ContentsThe Best Strategy To Use For Top 30 Forex BrokersThe 3-Minute Rule for Top 30 Forex BrokersTop 30 Forex Brokers Fundamentals ExplainedThe 7-Minute Rule for Top 30 Forex BrokersLittle Known Facts About Top 30 Forex Brokers.What Does Top 30 Forex Brokers Mean?Top 30 Forex Brokers Can Be Fun For EveryoneTop 30 Forex Brokers Things To Know Before You Buy

Each bar chart represents one day of trading and contains the opening price, highest rate, cheapest cost, and closing price (OHLC) for a profession. A dash on the left represents the day's opening price, and a similar one on the right represents the closing cost.Bar graphes for money trading assistance investors recognize whether it is a customer's or seller's market. The top section of a candle light is used for the opening price and greatest price point of a money, while the lower portion shows the closing cost and cheapest price factor.

The Ultimate Guide To Top 30 Forex Brokers

The developments and forms in candlestick graphes are utilized to recognize market instructions and activity.

Financial institutions, brokers, and dealers in the forex markets allow a high quantity of utilize, suggesting investors can manage huge settings with reasonably little cash. Utilize in the variety of 50:1 prevails in foreign exchange, though also greater amounts of leverage are available from certain brokers. However, utilize needs to be used very carefully because many unskilled investors have endured substantial losses making use of even more take advantage of than was needed or sensible.

The 9-Second Trick For Top 30 Forex Brokers

A currency investor needs to have a big-picture understanding of the economic climates of the various countries and their interconnectedness to grasp the principles that drive money values. The decentralized nature of foreign exchange markets implies it is much less controlled than other monetary markets. The extent and nature of regulation in foreign exchange markets depend on the trading jurisdiction.

Foreign exchange markets are amongst one of the most liquid markets on the planet. So, they can be much less unstable than various other markets, such as realty. The volatility of a certain money is a feature of several factors, such as the politics and business economics of its nation. Events like financial instability in the form of a payment default or imbalance in trading connections with one more money can result in considerable volatility.

The Main Principles Of Top 30 Forex Brokers

Currencies with high liquidity have an all set market and display smooth and predictable cost activity in reaction to outside events. The United state buck is the most traded currency in the globe.

Indicators on Top 30 Forex Brokers You Need To Know

In today's info superhighway the Foreign exchange market is no much longer solely for the institutional capitalist. The last 10 years have seen an increase in non-institutional investors accessing the Forex market and the benefits it provides.

The 7-Second Trick For Top 30 Forex Brokers

Fx trading (forex trading) is an international market for dealing money. At $6. 6 trillion, it is 25 times larger than all the world's supply markets. Foreign exchange trading determines the exchange rates for all flexible-rate currencies. Because of this, prices alter constantly for the currencies that Americans are more than likely to utilize.

All currency trades are performed in sets. When you market your currency, you get the settlement in a various money. Every vacationer who has obtained foreign currency has done foreign exchange trading. As an example, when you go on getaway to Europe, you trade bucks for euros at the going price. You sell U.S.

Top 30 Forex Brokers Things To Know Before You Buy

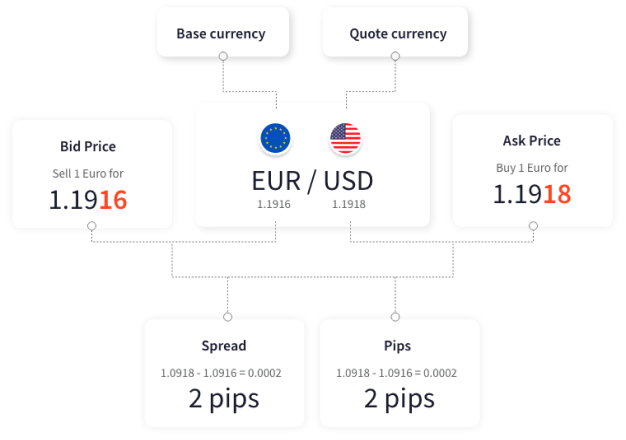

Spot transactions resemble exchanging money for a journey abroad. Places are agreements between the investor and the marketplace maker, or supplier. The investor gets a certain money at the buy cost from the market maker and sells a various currency at the market price. The buy cost is rather higher than the asking price.

This is the deal price to the trader, which in turn is the profit made by the market manufacturer. You paid this spread without understanding it when you exchanged your dollars for international currency. You would certainly discover it if you made the transaction, canceled your journey, and after that attempted to exchange the currency back to dollars today.

The Ultimate Guide To Top 30 Forex Brokers

You do this when you think the money's worth will fall in the future. If the money climbs in worth, you have to purchase it from the dealer at that price.